Archived

This campaign isn't about the issues POLITICS THREAD

Re: Failing banks. No one seriously is arguing that people don't get hurt when businesses fail. It's that propping them up when they are obsolete economically is extremely costly and inefficient, causing far more economic dislocation in the long run. The bailout in this case would be a huge misallocation of capital, at taxpayer expense, and ultimately would not work anyway.

The myth that needs to be exploded is that capitalism works for everyone. Rather, in capitalism, the market picks winners and losers. In planned economies, the political system does the picking instead. But in a dynamic economy of any variety, there are going to be winners and losers.

What we can do if we choose, via a welfare state (or safety net if you prefer) is to ensure that the losers do not end up wandering the streets of new industrial cities, and turn to beggary and thievery. I suppose we could take unemployed i-bankers and teach them skills that would make them employable again. I'm sure than can manage to become CNAs or something.

The myth that needs to be exploded is that capitalism works for everyone. Rather, in capitalism, the market picks winners and losers. In planned economies, the political system does the picking instead. But in a dynamic economy of any variety, there are going to be winners and losers.

What we can do if we choose, via a welfare state (or safety net if you prefer) is to ensure that the losers do not end up wandering the streets of new industrial cities, and turn to beggary and thievery. I suppose we could take unemployed i-bankers and teach them skills that would make them employable again. I'm sure than can manage to become CNAs or something.

Be Bold!

-

TenuredVulture - You've Got to Be Kidding Me!

- Posts: 53243

- Joined: Thu Jan 04, 2007 00:16:10

- Location: Magnolia, AR

FTN wrote:I don't think anyone believes this bill is the savior of the US economy. But its a stopgap to stabilize and then followups need to be put in place. Everyone agrees with that.

When the ambulance shows up at the crime scene and finds the gunshot victim, what do they do? They put a tourniquet on the wound, stop the bleeding, and get the person to the hospital. If they stand around, arguing over whether or not the gunshot wound is the worst they've ever seen, they might have to amputate, or the guy might not make it.

This bill isn't a fix all. Its a tourniquet needed to stabilize the economy until more measures can be put in place.

market: down 7% yesterday, up 4% today.

market's happy (trading is good for business), most people not as bad off as they thought at day's end yesterday.

Rationale for the rush to 'stabilize' anything by federal fiat that time won't on its own? The terms of the loans whose value is in question are not changed by the 'rescue measure' currently under consideration.

Yes, but in a double utley you can put your utley on top they other guy's utley, and you're the winner. (Swish)

-

drsmooth - BSG MVP

- Posts: 47349

- Joined: Thu Dec 28, 2006 19:24:48

- Location: Low station

drsmooth wrote:FTN wrote:I don't think anyone believes this bill is the savior of the US economy. But its a stopgap to stabilize and then followups need to be put in place. Everyone agrees with that.

When the ambulance shows up at the crime scene and finds the gunshot victim, what do they do? They put a tourniquet on the wound, stop the bleeding, and get the person to the hospital. If they stand around, arguing over whether or not the gunshot wound is the worst they've ever seen, they might have to amputate, or the guy might not make it.

This bill isn't a fix all. Its a tourniquet needed to stabilize the economy until more measures can be put in place.

market: down 7% yesterday, up 4% today.

market's happy (trading is good for business), most people not as bad off as they thought at day's end yesterday.

Rationale for the rush to 'stabilize' anything by federal fiat that time won't on its own? The terms of the loans whose value is in question are not changed by the 'rescue measure' currently under consideration.

Or the markets are responding to the fact that with the talk coming out of the Senate today, the prospects of a bailout bill look much brighter than they did at COB yesterday.

-

jerseyhoya - BSG MVP

- Posts: 97408

- Joined: Fri Sep 07, 2007 21:56:17

jerseyhoya wrote:drsmooth wrote:FTN wrote:I don't think anyone believes this bill is the savior of the US economy. But its a stopgap to stabilize and then followups need to be put in place. Everyone agrees with that.

When the ambulance shows up at the crime scene and finds the gunshot victim, what do they do? They put a tourniquet on the wound, stop the bleeding, and get the person to the hospital. If they stand around, arguing over whether or not the gunshot wound is the worst they've ever seen, they might have to amputate, or the guy might not make it.

This bill isn't a fix all. Its a tourniquet needed to stabilize the economy until more measures can be put in place.

market: down 7% yesterday, up 4% today.

market's happy (trading is good for business), most people not as bad off as they thought at day's end yesterday.

Rationale for the rush to 'stabilize' anything by federal fiat that time won't on its own? The terms of the loans whose value is in question are not changed by the 'rescue measure' currently under consideration.

Or the markets are responding to the fact that with the talk coming out of the Senate today, the prospects of a bailout bill look much brighter than they did at COB yesterday.

well, let's see what alternative scenarios might have materialized:

a) pelosi moons boehner, who sprouts one & uses it on her

b) greenwich hedge fund guys grumble that their investors' plans to pull out en masse and leave them clinging to a shack on 5 acres north of the Merritt are being ignored by DC

c) a trickle of good news - "hey! one house of congress is still at work on this thing!" - comes out & people decide the sun has not exploded

I'm not sure it's wise to treat the metrics much differently than you do baseball data - one great or bad day, heck even a great or bad week, rarely captures a player's or a team's or even a league's season very accurately.

But you're the guy who cited that "market losses were 50% greater than the $750 billion bailout list price" bailout salesman's line yesterday (& echoed by Sunny Charlie Gibson in yesterday's ABC broadcast - you weren't alone), so I don't know

Yes, but in a double utley you can put your utley on top they other guy's utley, and you're the winner. (Swish)

-

drsmooth - BSG MVP

- Posts: 47349

- Joined: Thu Dec 28, 2006 19:24:48

- Location: Low station

drsmooth wrote:But you're the guy who cited that "market losses were 50% greater than the $750 billion bailout list price" bailout salesman's line yesterday (& echoed by Sunny Charlie Gibson in yesterday's ABC broadcast - you weren't alone), so I don't know

I know. That Bloomberg News is a really obscure place to get financial news.

-

jerseyhoya - BSG MVP

- Posts: 97408

- Joined: Fri Sep 07, 2007 21:56:17

Something the left has to be careful of is that they don't go too far picking on Palin, or there may be an unintended effect of people thinking she's getting picked on or being treated unfairly (possibly to the extent of some perceived misogyny). This is sort of what happened with HRC, and she used that to her advantage and went populist... thus her surprising "comeback" at the tail of the primaries where she finished much stronger than Obama but fell short. The left has to be careful not to come off as major sphincters in the eyes of the middle.

I never understood this...'the left' is majority female. Can they be self-hating or something?

thephan wrote:pacino's posting is one of the more important things revealed in weeks.

Calvinball wrote:Pacino was right.

-

pacino - Moderator / BSG MVP

- Posts: 75831

- Joined: Thu Dec 28, 2006 18:37:20

- Location: Furkin Good

TenuredVulture wrote:Re: Failing banks. No one seriously is arguing that people don't get hurt when businesses fail. It's that propping them up when they are obsolete economically is extremely costly and inefficient, causing far more economic dislocation in the long run. The bailout in this case would be a huge misallocation of capital, at taxpayer expense, and ultimately would not work anyway.

The myth that needs to be exploded is that capitalism works for everyone. Rather, in capitalism, the market picks winners and losers. In planned economies, the political system does the picking instead. But in a dynamic economy of any variety, there are going to be winners and losers.

.

This is pretty much how I see it, for right or wrong. The strong survive and the weak and/or stupid are replaced. Companies aren't people, even if they do have some of the same rights.

So I prefer they take another week, if necessary, and fully vet the other ideas floating around to make sure they get this right. I couldn't care less if the banks fail if they have another way of stabilizing the economy. Wall Street isn't going to self destruct in that time..... big money won't let that happen.

Agnostic dyslexic insomniacs lay awake all night wondering if there is a Dog.

-

Monkeyboy - Plays the Game the Right Way

- Posts: 28452

- Joined: Sat Feb 17, 2007 21:01:51

- Location: Beijing

Monkeyboy wrote:TenuredVulture wrote:Re: Failing banks. No one seriously is arguing that people don't get hurt when businesses fail. It's that propping them up when they are obsolete economically is extremely costly and inefficient, causing far more economic dislocation in the long run. The bailout in this case would be a huge misallocation of capital, at taxpayer expense, and ultimately would not work anyway.

The myth that needs to be exploded is that capitalism works for everyone. Rather, in capitalism, the market picks winners and losers. In planned economies, the political system does the picking instead. But in a dynamic economy of any variety, there are going to be winners and losers.

.

This is pretty much how I see it, for right or wrong. The strong survive and the weak and/or stupid are replaced. Companies aren't people, even if they do have some of the same rights.

So I prefer they take another week, if necessary, and fully vet the other ideas floating around to make sure they get this right. I couldn't care less if the banks fail if they have another way of stabilizing the economy. Wall Street isn't going to self destruct in that time..... big money won't let that happen.

Companies ARE people. They are made up entirely of people and the gains and losses effect those invovled. Not sure why we can't get past that idea. Who owns these companies? To a certain extent, regular ol' people

thephan wrote:pacino's posting is one of the more important things revealed in weeks.

Calvinball wrote:Pacino was right.

-

pacino - Moderator / BSG MVP

- Posts: 75831

- Joined: Thu Dec 28, 2006 18:37:20

- Location: Furkin Good

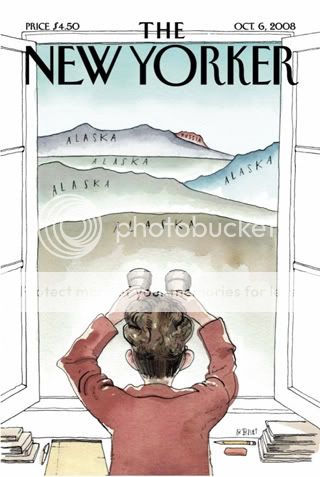

Camp Holdout wrote:Bracing for More Palin

Howard Kurtz reviews last week's trainwreck interviews Katie Couric did with Gov. Sarah Palin and notes "the worst may be yet to come for Palin; sources say CBS has two more responses on tape that will likely prove embarrassing."

Update: Ben Smith confirms "the recorded segments are scheduled to air Wednesday and Thursday before the vice presidential debate."

She did not know a single other Supreme Court case besides Roe v. Wade. This was not followed with a trademark ramble either, but, rather, silence.

-

karn - BSG MVP

- Posts: 12241

- Joined: Thu Dec 28, 2006 18:21:30

- Location: BEACH

karn wrote:Camp Holdout wrote:Bracing for More Palin

Howard Kurtz reviews last week's trainwreck interviews Katie Couric did with Gov. Sarah Palin and notes "the worst may be yet to come for Palin; sources say CBS has two more responses on tape that will likely prove embarrassing."

Update: Ben Smith confirms "the recorded segments are scheduled to air Wednesday and Thursday before the vice presidential debate."

She did not know a single other Supreme Court case besides Roe v. Wade. This was not followed with a trademark ramble either, but, rather, silence.

is that what one of the clips is? i havent seen anything leaked...

it is apparently this series http://www.cbsnews.com/stories/2008/09/ ... 3216.shtml but for the VP's

edit: answered myself: http://www.huffingtonpost.com/2008/09/2 ... 30395.html

-

Camp Holdout - There's Our Old Friend

- Posts: 1032

- Joined: Sun Mar 11, 2007 15:48:32

- Location: NYC

jeff2sf wrote:I had heard the same things dajafi heard (though I'm not sure if I heard them FROM dajafi but that's neither here nor there.

I'm curious though... has anyone speculated on why he didn't choose Huckabee? Doesn't he basically have the same political ideas as Palin, longer experience as governor, handles the media better than Palin, more vetted by virtue of his run than Palin, and just all in all charming enough so that I'm beguiled enough to not question his and McCain's sanity on a daily basis?

Never mind the fact that as somewhat of a populist, his message would be resonating nicely during the economic crisis.

Now THAT is a damn good question. Huckabee is as likable politican as I can remember, even if I disagree with much of his philosophy, especially his social conservatism.

Is it the same (stupid) reason Obama didn't pick Hillary? I don't feel like their primary was contested enough to be damaging to their future relationship, but... maybe it was.

"I'm in a bar with the games sound turned off and that Cespedes home run still sounded like inevitability."

-swish

-swish

-

Wolfgang622 - Plays the Game the Right Way

- Posts: 28653

- Joined: Sat Jan 06, 2007 23:11:51

- Location: Baseball Heaven

But Palin... he can't undo that now. It would be like admitting, "I can't pick a vice-Presidential candidate to save my ass. But I can save this country. Vote McCain!"

Frankly, though, I think it's rapidly approaching the point that it doesn't matter what he does; it's looking more and more like an Obama blowout to Nate Silver and, thus, to me - www.fivethirtyeight.com

Frankly, though, I think it's rapidly approaching the point that it doesn't matter what he does; it's looking more and more like an Obama blowout to Nate Silver and, thus, to me - www.fivethirtyeight.com

"I'm in a bar with the games sound turned off and that Cespedes home run still sounded like inevitability."

-swish

-swish

-

Wolfgang622 - Plays the Game the Right Way

- Posts: 28653

- Joined: Sat Jan 06, 2007 23:11:51

- Location: Baseball Heaven

pacino wrote:Monkeyboy wrote:TenuredVulture wrote:Re: Failing banks. No one seriously is arguing that people don't get hurt when businesses fail. It's that propping them up when they are obsolete economically is extremely costly and inefficient, causing far more economic dislocation in the long run. The bailout in this case would be a huge misallocation of capital, at taxpayer expense, and ultimately would not work anyway.

The myth that needs to be exploded is that capitalism works for everyone. Rather, in capitalism, the market picks winners and losers. In planned economies, the political system does the picking instead. But in a dynamic economy of any variety, there are going to be winners and losers.

.

This is pretty much how I see it, for right or wrong. The strong survive and the weak and/or stupid are replaced. Companies aren't people, even if they do have some of the same rights.

So I prefer they take another week, if necessary, and fully vet the other ideas floating around to make sure they get this right. I couldn't care less if the banks fail if they have another way of stabilizing the economy. Wall Street isn't going to self destruct in that time..... big money won't let that happen.

Companies ARE people. They are made up entirely of people and the gains and losses effect those invovled. Not sure why we can't get past that idea. Who owns these companies? To a certain extent, regular ol' people

But those jobs will move to other companies where those people can get jobs. I don't think the financial sector is going to disappear.

And I'm certainly not saying it won't be painful. I just think it would be better for the people in the long run. Let's put it this way, how many people are going to lose jobs if inflation and unemployment go up because of the 700 billion bailout? I would rather lose banking jobs than jobs across the board. I would rather see some money going towards helping the banking people find new jobs and helping homeowners get some relief (though homeowners shouldn't be completely off the hook either) than bailing out companies that took unnecessary risks and tried to fool people into thinking everything was fine.

I realize that it will be very painful, but I don't think there's an easy or completely fair answer.

Agnostic dyslexic insomniacs lay awake all night wondering if there is a Dog.

-

Monkeyboy - Plays the Game the Right Way

- Posts: 28452

- Joined: Sat Feb 17, 2007 21:01:51

- Location: Beijing

Monkeyboy wrote:pacino wrote:Monkeyboy wrote:TenuredVulture wrote:Re: Failing banks. No one seriously is arguing that people don't get hurt when businesses fail. It's that propping them up when they are obsolete economically is extremely costly and inefficient, causing far more economic dislocation in the long run. The bailout in this case would be a huge misallocation of capital, at taxpayer expense, and ultimately would not work anyway.

The myth that needs to be exploded is that capitalism works for everyone. Rather, in capitalism, the market picks winners and losers. In planned economies, the political system does the picking instead. But in a dynamic economy of any variety, there are going to be winners and losers.

.

This is pretty much how I see it, for right or wrong. The strong survive and the weak and/or stupid are replaced. Companies aren't people, even if they do have some of the same rights.

So I prefer they take another week, if necessary, and fully vet the other ideas floating around to make sure they get this right. I couldn't care less if the banks fail if they have another way of stabilizing the economy. Wall Street isn't going to self destruct in that time..... big money won't let that happen.

Companies ARE people. They are made up entirely of people and the gains and losses effect those invovled. Not sure why we can't get past that idea. Who owns these companies? To a certain extent, regular ol' people

But those jobs will move to other companies where those people can get jobs. I don't think the financial sector is going to disappear.

And I'm certainly not saying it won't be painful. I just think it would be better for the people in the long run. Let's put it this way, how many people are going to lose jobs if inflation and unemployment go up because of the 700 billion bailout? I would rather lose banking jobs than jobs across the board. I would rather see some money going towards helping the banking people find new jobs and helping homeowners get some relief (though homeowners shouldn't be completely off the hook either) than bailing out companies that took unnecessary risks and tried to fool people into thinking everything was fine.

I realize that it will be very painful, but I don't think there's an easy or completely fair answer.

Why on earth would more jobs get lost because of the bailout as opposed to doing nothing? Banking jobs are gone and not coming back (till the next bubble). But I have no idea how you can paint a picture where unemployment goes up because of the bailout.

- jeff2sf

- There's Our Old Friend

- Posts: 3395

- Joined: Sat Dec 30, 2006 10:40:29

CFP wrote:Geez... not one? Did she pay attention to the recent court cases? D.C. v. Heller? Anything. Lawrence v. Texas. Mapp v. Ohio. Brown v. Board. Come on.

Rigid activist conservatives often don't recognize (or pooh-pooh) stare decisis. So prior SCOTUS rulings are irrelevant.

Lifeline to Sarah from me. Grab it!

Foreskin stupid

-

Bakestar - BSG MVP

- Posts: 14709

- Joined: Thu Dec 28, 2006 17:57:53

- Location: Crane Jackson's Fountain Street Theatre

CFP wrote:Geez... not one? Did she pay attention to the recent court cases? D.C. v. Heller? Anything. Lawrence v. Texas. Mapp v. Ohio. Brown v. Board. Come on.

i wonder if they'll call this one "gotcha journalism" seeing as the same exact questions are asked of joe biden apparently...

-

Camp Holdout - There's Our Old Friend

- Posts: 1032

- Joined: Sun Mar 11, 2007 15:48:32

- Location: NYC

jerseyhoya wrote:drsmooth wrote:But you're the guy who cited that "market losses were 50% greater than the $750 billion bailout list price" bailout salesman's line yesterday (& echoed by Sunny Charlie Gibson in yesterday's ABC broadcast - you weren't alone), so I don't know

I know. That Bloomberg News is a really obscure place to get financial news.

what's obscure got to do with insipid?

The juxtaposition of those 'facts' doesn't produce any useful thinking about the matter at hand

Yes, but in a double utley you can put your utley on top they other guy's utley, and you're the winner. (Swish)

-

drsmooth - BSG MVP

- Posts: 47349

- Joined: Thu Dec 28, 2006 19:24:48

- Location: Low station

Camp Holdout wrote:CFP wrote:Geez... not one? Did she pay attention to the recent court cases? D.C. v. Heller? Anything. Lawrence v. Texas. Mapp v. Ohio. Brown v. Board. Come on.

i wonder if they'll call this one "gotcha journalism" seeing as the same exact questions are asked of joe biden apparently...

all this is lawyer talk which my girl's constituency finds elitist

Yes, but in a double utley you can put your utley on top they other guy's utley, and you're the winner. (Swish)

-

drsmooth - BSG MVP

- Posts: 47349

- Joined: Thu Dec 28, 2006 19:24:48

- Location: Low station